Navigating the Stock Market: A Beginner’s Investment Guide

Introduction:

The stock market can seem like a complex and intimidating world for beginners. However, with the right knowledge and guidance, investing in stocks can be a rewarding way to grow your wealth over time. This beginner’s investment guide will provide you with essential information to navigate the stock market confidently. From understanding the basics of stocks to developing an investment strategy and managing risk, we’ll explore key concepts that will help you embark on your investment journey.

- Understanding Stocks and the Stock Market:

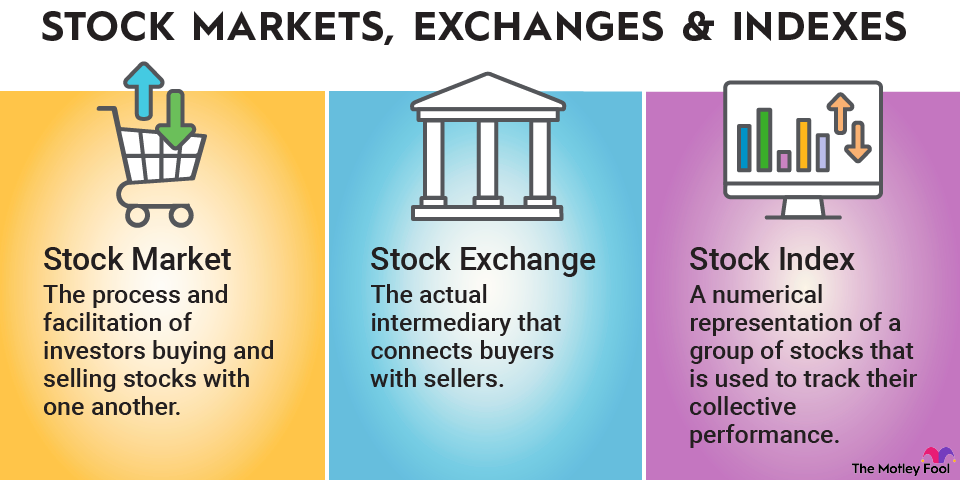

Stocks represent ownership in a company and are traded on the stock market. The stock market is a platform where buyers and sellers come together to trade stocks. Familiarize yourself with basic stock market terminology, such as stocks, shares, dividends, market capitalization, and indices. Learn how stock prices are determined by supply and demand and influenced by various factors, including company performance, economic conditions, and investor sentiment.

- Setting Investment Goals:

Before entering the stock market, define your investment goals. Determine your time horizon, risk tolerance, and financial objectives. Are you investing for retirement, a down payment on a house, or funding your children’s education? Clear goals will help shape your investment strategy and guide your decision-making process. - Conducting Fundamental Research:

When investing in stocks, it’s essential to research the underlying companies. Understand their business models, financial health, competitive advantages, and growth prospects. Review financial statements, such as income statements, balance sheets, and cash flow statements. Analyze key metrics like revenue growth, profit margins, and return on equity. Consider qualitative factors like industry trends, management team, and competitive landscape. - Embracing a Long-Term Perspective:

Successful investing in the stock market requires a long-term perspective. Avoid getting swayed by short-term market fluctuations and focus on the potential growth and compounding effects over time. Develop a buy-and-hold strategy that aligns with your investment goals. Historically, the stock market has shown consistent growth over the long run, despite short-term volatility. - Diversifying Your Portfolio:

Diversification is key to managing risk in the stock market. Spreading your investments across different sectors, industries, and geographic regions helps reduce the impact of any single stock’s performance on your overall portfolio. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks. Additionally, diversify your investments by including other asset classes like bonds, real estate, or index funds. - Developing an Investment Strategy:

Create a well-defined investment strategy based on your goals, risk tolerance, and research. Determine your asset allocation, which is the percentage of your portfolio allocated to different asset classes. Decide on your investment style, whether it’s value investing, growth investing, or a combination of both. Establish criteria for buying and selling stocks, such as target price levels or specific valuation metrics.

- Practicing Risk Management:

Managing risk is crucial in the stock market. Set a stop-loss order to limit potential losses on individual stocks. This order automatically sells a stock if it reaches a predetermined price. Avoid investing more than you can afford to lose and maintain an emergency fund to protect yourself during financial downturns. Regularly review your portfolio’s performance and make adjustments as needed. - Staying Informed:

Stay updated on market news, economic trends, and company-specific developments. Follow reputable financial news sources and subscribe to newsletters or publications that provide insights into the stock market. Stay informed about any regulatory changes or market events that may impact your investments. However, be cautious of media noise and avoid making impulsive investment decisions based solely on news headlines. - Utilizing Investment Tools and Resources:

Take advantage of investment tools and resources available to you. Online brokerage platforms offer user-friendly interfaces for trading stocks and accessing research reports. Utilize stock screeners to filter stocks based on your investment criteria. Stay informed about dividends, earnings reports, and upcoming company events that may impact stock prices. - Seeking Professional Advice When Needed:

Consider seeking professional advice from a financial advisor or investment professional. They can provide personalized guidance based on your financial situation, goals, and risk tolerance. A professional can offer insights, help you navigate complex investment options, and provide recommendations tailored to your needs. Ensure that your advisor is reputable, experienced, and aligned with your investment philosophy.

Conclusion:

Navigating the stock market as a beginner may seem daunting, but with the right knowledge and approach, it can be a rewarding journey. Understand the basics of stocks, conduct thorough research, and develop a well-defined investment strategy. Embrace a long-term perspective and diversify your portfolio to manage risk effectively. Stay informed, utilize investment tools, and consider seeking professional advice when needed. By following these guidelines and continuously expanding your investment knowledge, you can confidently navigate the stock market and work towards achieving your financial goals.